This is my brief guide on how to redeem your free Secretlab chair from MyRepublic via their broadband plan. This is from my personal experience signing up for the plan and redeeming a Secretlab Tital Evo 2022 chair myself.

How to redeem your free Secretlab chair from MyRepublic

Step 1. Sign up for MyRepublic plan with Secretlab gaming chair

Sign up for an appropriate broadband plan with MyRepublic which offers the Secretlab chair as a sign up bonus promotion (premium) item.

I signed up for the "Secretlab TITAN Evo 2022 1Gbps Broadband" plan with MyRepublic.

Secretlab TITAN Evo 2022 1Gbps Broadband

https://myrepublic.net/sg/secretlab-titan-evo-2022-gamer-1gbps-broadband/

You may see that it is $69.99 SGD per month which is the Gamer plan version, however, if you click around their website you can actually get it at a Normal plan available as well which is priced at $64.99 which is I believe is better value.

So depends if you want the Gamer plan or the Normal plan.

- Go to https://myrepublic.net/sg/broadband-promotions

- Click on the "Broadband with Lifestyle Products" tab

- Scroll and you should find "Secretlab TITAN Evo 2022 1Gbps Broadband" plan. Then click "Get this plan" and sign up from there.

Step 2. Wait for email from MyRepublic for redemption

Step 3. Receive email from MyRepublic for Secretlab chair redemption

Thank you for signing up with us! We are happy to inform you that your Secretlab TITAN Evo 2022 Gaming Chair is ready for redemption.

To redeem, please click on the Secretlab webpage link and input redemption code <REDEEMCODE>.

Step 4. Go to Secretlab webpage for your Secretlab chair

Step 5. Customise your Secretlab gaming chair accordingly

- Size, colour, address and date of delivery can be selected - You can select the colour, address and date of delivery of your Secretlab TITAN Evo 2022 Gaming Chair via the given link. Chair colours are subject to stock availability.

- MyRepublic says that NAPA Leather, Special Edition

variants, XL size are not redeemable* - NAPA Leather and Special Edition

variants are not applicable. XL size is also not included.

- Delivery will be free - Flat packed delivery will be free (U.P. $20).

- Assembly cost is not included - Assembly of TITAN Evo 2022 Gaming Chair by Secretlab technician (optional), will be an additional $29 (U.P. $49). That is, please note that assembly cost is not included.

- You will have to either assemble the Secretlab chair yourself or

- Pay $29 SGD to Secretlab for their assembly service.

- Size of your chair: Small or Regular (MyRepublic says XL not available with this redemption)

- Upholstery type: Leatherette or Softweave, and

- Colour.

Size of chair

Small or Regular (MyRepublic says XL not available with this redemption)

Upholstery type and Colour

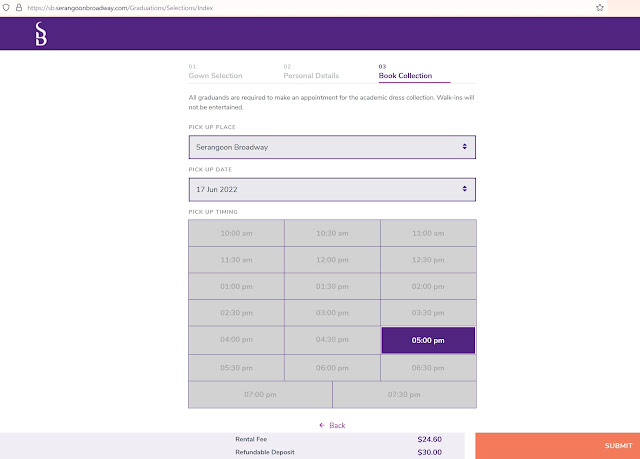

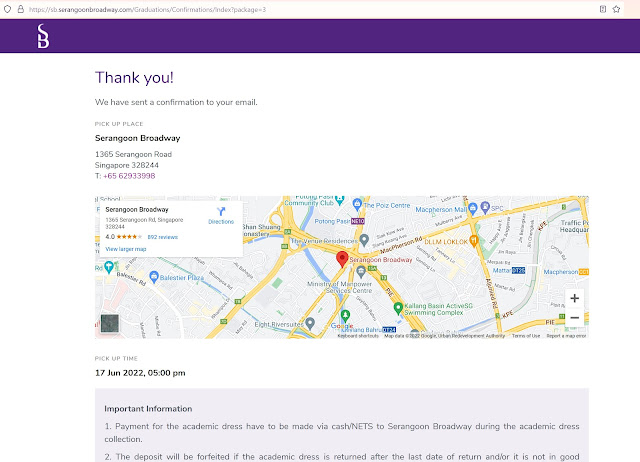

Step 6. Make your purchase when you're ready

Follow the prompts on your "Shopping Cart" and checkout to make your purchase.

Optionally, adding assembly ($29 SGD) looks something like this.

Step 7. Wait for your chair to arrive and get assembled

Optional - Post on social media for extra 2 years warranty extension

You may get offered by Secretlab an option to extend your warranty if you would like to post your experiences on social media. As a reward for doing so, they will offer you 2 years free warranty extension. https://secretlab.sg/pages/redeem

Show us [Secretlab] a public post of your new Secretlab chair, and get your warranty extended to a total of 5 years, so you can sit easier for even longer than before.

Enjoy 5 years of peace of mind when you join [Secretlab] Extended Warranty Program

- Exclusive to the Secretlab 2022 and Secretlab Classics

- You will be able to extend your Secretlab 2022 Series or Secretlab Classics warranty from 3 years to 5 years.

Secretlab Terms and Conditions

- The post must be Public.

- Only Secretlab 2022 Series / Secretlab Classics chairs fulfilled within one year of the application for warranty extension will qualify.

- Warranty is extendible only once per chair.

- You will receive a status update on your application via email within 5 working days.

- Be aware that local laws may require you to add #promotion, #ad or your local language equivalent (e.g., #Werbung in Germany) to your post.

- Secretlab has absolute discretion to change the parameters of the warranty extension program at any time. Secretlab’s decisions on all aspects of this program are final and binding.

OR

You can choose to purchase the warranty coverage ($69.00 SGD)

https://accessories.secretlab.co/products/2-year-warranty-extension#stop_redirect

Secretlab Warranty Extension Terms and Conditions

- Secretlab Chairs are designed and certified for safety and durability. Sit with a peace of mind extend your warranty to a total of 5 years.

- To be eligible for this purchase, you will be required to have purchased a chair.

- Upon purchase, you will receive a status update of your extension via email in 5 working days.

- Only Secretlab 2022/Secretlab Classics chairs will qualify.

- Warranty is extendible only once per qualified chair.

- Warranty extension must be paid for before the end of the qualified chair’s 3-year warranty period based on our records.

- If you change your mind about buying the warranty, you must inform us about your decision to cancel within 14 days from your date of purchase.

- You will receive a status update on your application via email within 5 working days.

- Secretlab has absolute discretion to change the parameters of the warranty extension program at any time. Secretlab’s decisions on all aspects of this program are final and binding.

- The warranty extension is not offered in the (1) State of Texas, United States or (2) Australia.

Not on social media?

Legal - Secretlab TITAN Evo 2022 1Gbps Broadband Terms & Conditions from MyRepublic

Legal > Fixed Broadband > Individual Promotions > Secretlab TITAN Evo 2022 1Gbps BroadbandSecretlab TITAN Evo 2022 1Gbps Broadband Terms & Conditions

- Based on a 24-month contract for MyRepublic 1Gbps Fibre Broadband (“Service”).

- Service subscription price of $64.99/month applies for 24 months (Usual price of $59.99/month, will apply after your contract ends).

- Recontracting customers will enjoy an additional one-time $30 bill rebate on the first month of the contract.

- Customer can choose either small or regular size Secretlab TITAN Evo 2022 gaming chair. Size XL is not applicable. No return/exchange of sizes/variants upon redemption.

- You can only redeem the Secretlab TITAN Evo 2022 (worth up to $609) (“Premium”) upon receiving the Redemption Letter. The Redemption Letter will be sent to your registered email after successful installation of your MyRepublic service and the full payment of your first month’s bill, or any outstanding MyRepublic bills, if applicable. If you have not received the Redemption Letter within 14 days after your Service has been installed and full payment of first month’s bill (whichever that occurs later), please contact our Customer Service.

- You must comply with our instructions in the Redemption Letter to facilitate the collection of Premium.

- Any Premium not claimed or collected within 4 months from the date in the respective Redemption Letter will be forfeited and shall no longer be available for redemption, at our sole and absolute discretion. We will not compensate you for any uncollected, forfeited lost, misplaced, damaged, or stolen Premiums.

- Normal plan Terms and Conditions - myrepublic.net/sg/legal/fixed-broadband/individual-promotions/legal-secretlab-titan-evo-1gbps-broadband

- Gamer plan Terms and Conditions - myrepublic.net/sg/legal/fixed-broadband/individual-promotions/legal-secretlab-titan-evo-2022-gamer-1gbps-broadband

If you need further help from Secretlab, you can also reach out to them on [email protected] or https://secretlab.sg/pages/contact.